alameda county property tax calculator

If the tax rate in your community has been established at 120 1 base rate plus 20 for prior indebtedness the property tax would be calculated as follows. The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of 068 of property value.

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

Look Up Your Property Taxes.

. If you have atypical situations or have additional questions about supplemental assessments please call the Assessors Office at 510 272-3787. If you have any questions about the application or disaster relief please call our office at 510 272. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

No fee for an electronic check from your checking or savings account. Find your actual property tax payment incorporating any exemptions that apply to your real estate. Alameda County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax.

Property taxes in America are collected by local governments and are usually based on the value of a property. Alameda County collects on average 068 of a propertys assessed fair market value as property tax. Then question if the size of the increase is worth the time and effort it will take to appeal the assessment.

Click on the map to expand. A convenience fee of 25 will be charged for a credit card transaction. Find Information On Any Alameda County Property.

The money collected is generally used to support community safety schools infrastructure and other public projects. Because the rate is 120 of assessed value Multiply the rate times the assessed value. Ad See your Propertys Market Value Free It Just Takes Seconds.

Property Information Property State. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. Get In-Depth Property Tax Data In Minutes.

No fee for an electronic check from your checking or savings account. Start filing your tax return now. Alameda County in California has a tax rate of 925 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Alameda County totaling 175.

You can find more tax rates and allowances for Alameda County and California in the 2022 California Tax Tables. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612. For tax balances please choose one of the following tax types.

This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. Start Your Homeowner Search Today. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Alameda County Sales Tax Rates for 2022. For comparison the median home value in Los Angeles County is 50880000. Ad Need Property Records For Properties In Alameda County.

Welcome to the TransferExcise Tax Calculator. Search Any Address 2. Pay Your Property Taxes Online.

The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900. You can pay online by credit card or by electronic check from your checking or savings account. Dear Alameda County Residents.

Denotes required field. The tax type should appear in the upper left corner of your bill. At this point property owners usually order service of one of the best property tax attorneys in Alameda CA.

125 12th Street Suite 320 Oakland CA 94607. Denotes required field. To use the Supplemental Tax Estimator please follow these instructions.

See Property Records Tax Titles Owner Info More. The median property tax on a 59090000 house is 401812 in Alameda County. Property Information Property State.

The median property tax on a 59090000 house is 437266 in California. For payments made online a convenience fee of 25 will be charged for a credit card transaction. Enter the purchase date in mmddyyyy format eg 05152007.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Los Angeles. This map shows property tax in correlation with square footage of the property. The median property tax on a 59090000 house is 620445 in the United States.

TAX DAY NOW MAY 17th - There are -446 days left until taxes are. Alameda County has one of the highest median property taxes in the United States and is ranked 68th of the 3143 counties in order of median property taxes. Welcome to the TransferExcise Tax Calculator.

If your property has been affected by the recent Canyon Fire in the Sunol Pleasanton or Niles-Fremont region please click here for the Application for Reassessment of Damaged or Destroyed Property and more information on Disaster Relief. Overview of Property Taxes. We accept Visa MasterCard Discover and American Express.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Lake Garden Celebration Fl

State Of The State Polls Sayings Word Search Puzzle

Transfer Tax Alameda County California Who Pays What

Understanding California S Property Taxes

In States With Property Tax On Cars Do I Also Have To Pay Sales Tax Mansion Global

Understanding California S Property Taxes

Search Unsecured Property Taxes

Alameda County Ca Property Tax Search And Records Propertyshark

Will Home Prices Continue To Rise In Socal Real Estate Trends Real Estate Tips House Prices

Alameda County Ca Property Tax Calculator Smartasset

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Lake Garden Celebration Fl

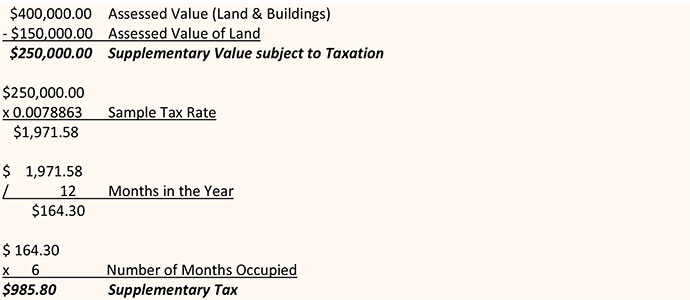

How Is Supplementary Tax Calculated The City Of Red Deer

Property Taxes By State County Lowest Property Taxes In The Us Mapped